The cash flow funnel: A new B2B marketing funnel that is customer and finance-centric

“The most important search engine is still the one in your mind.”

This statement makes a point that all marketers should internalize about buyer behavior: most purchases start not by searching on Google, but by searching our memory. If we believe buyer behavior begins with memory, it then follows that the job of marketing is not to generate clicks, but to create memories.

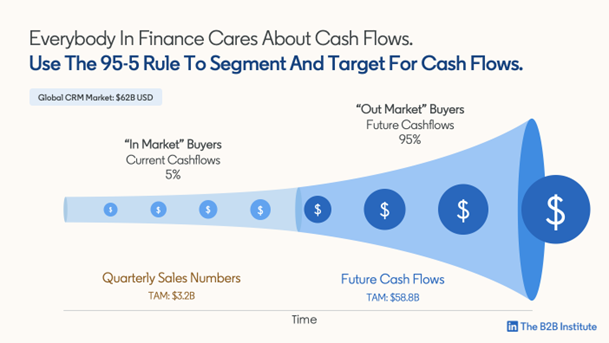

In partnership with the Ehrenberg-Bass Institute, Ty Heath, Director of Marketing Engagement at LinkedIn’s B2B Institute, offers a new model for B2B brands to do just that. The ‘cash flow funnel,’ is both customer-centric and finance-centric. It recognizes that current buyers are the source of current cash flows, while future buyers are the source of future cash flows. And the way to capture those future cash flows is to build mental availability among your out-market buyers so that when they do enter the market, your brand is the one they think of.

Understanding and investing in category entry points is the key to building mental availability, so you can win the mind to win the market. In the first of a series of Q&As, Ty Heath explains how category entry points and the cash flow funnel can help marketers build memorable brands.

Q1: What are the origins of ‘the cash flow funnel’ and ‘category entry points?’

Ty Heath: The Ehrenberg-Bass Institute is a renowned academic institution that studies marketing science to discover how brands grow. Professor Jenni Romaniuk, Research Professor at Ehrenberg-Bass, developed a concept called category entry points.

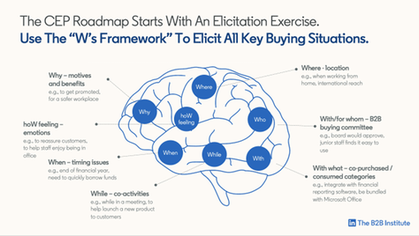

Category entry points (CEPs) are the cues that category buyers use to access their memories when faced with a buying situation and can include any internal cues (e.g., motives, emotions) and external cues (e.g., location, time of day) that affect any buying situation. CEPs revolutionize how marketers think about the buyer journey, and it helps place marketers in the minds of their buyers so we can link our brands to relevant memories that create brand sales.

My team at the B2B Institute developed the cash flow funnel over the past 5 years to incentivize marketers to take the long view. Marketing works over the long term by generating future cash flows, so we flipped the traditional funnel on its side to recognize that. And once we realized that building mental availability was the key to capturing sales from future buyers, it only made sense to study category entry points. CEPs are the key to building mental availability, and we were fascinated by CEPs as a customer-centric, rather than brand-centric, approach to marketing.

Q2: Where does the traditional marketing funnel fall short?

Ty Heath: Every marketer is familiar with the marketing funnel, which nudges customers along a journey from awareness to consideration to purchase.

We need to think about marketing differently.

Firstly, the traditional marketing funnel does not speak the language of finance. Secondly, it does not reflect customer realities. We believe that customers are not in the awareness stage or consideration stage. They are either ‘in-market’ or ‘out-market’ for buying your product or service. And if they are out-market, they are not even thinking about your brand or your category at all.

So, between it not being customer-centric or finance-centric, we think we need a new model that better represents how buyer decision-making occurs, and that speaks to the language of finance.

Q3: What is the updated marketing funnel you are proposing?

Ty Heath: We are proposing the cash flow funnel, so named to immediately speak the language of finance.

Imagine the traditional funnel turned on its side and stretched out over time. The cash flow funnel recognizes that buyers are either in-market or out-market. In-market customers drive current cash flows and out-market customers drive future cash flows.

This is connected to the 95-5 Rule that our team published in collaboration with Professor John Dawes at Ehrenberg-Bass as part of our ‘How B2B Brands Grow’ research. At any given time, 95% of your customers are out-market and are future buyers. This means only 5% of your customers are in-market at any given time. While it is important to reach the customers who are willing to buy from you today, your growth potential lies in reaching the 95% – the customers who will not buy from you today but will buy from you in the future.

The cash flow funnel is a fantastic way to have a conversation with your finance department about marketers’ value to the business. Marketing is not a cost of doing business – it is an innovative way to reach future buyers and build brand-relevant memories. The cash flow funnel cements the importance of making sure buyers remember your brand when they come in-market.

Q4: What role do memories play in the cash flow funnel?

Ty Heath: The most important search engine is the one in your mind. When people start thinking about buying, they start not by searching Google, but by searching their memory. What brands do they know that are in that category? Your job as a marketer is to build those memory structures.

Memories are highly situational. Our team even looked at a study that showed if you learn vocabulary underwater, your recall is best underwater. It is the same reason you might replicate the test environment when preparing for an exam. In other words, memories rarely exist independent of some sort of situational trigger. Most conscious recall happens this way, and it is the same for brands as well.

This idea of building situational awareness is the concept behind category entry points. Category entry points are the methodology to start linking your brand to relevant buying situations, so your buyers remember you when they move in-market.

Q5: What is the financial consequence of marketing only to one of those buyer groups?

Ty Heath: What tends to happen is B2B marketers focus on lead generation, because it is very measurable and because we need to produce results in the short term. This means most B2Bmarketers are focusing exclusively on the 5% of in-market buyers.

This short-term focus is at the expense of the 95%. Say you are a company in the CRM category which has a $62 billion market size. Focusing exclusively on the 5% shrinks your Total Addressable Market (TAM) from $62 billion to $3.2 billion. You must invest in building situational awareness among in-market AND out-market to reach your full TAM potential.

The other thing to remember is that according to a LinkedIn career pathing study, at least 10% of your category is going to turn over every year. Focusing on in-marketer customers does not prepare you for the long term whatsoever.

Q6: When does an out-market consumer become in-market in the new marketing funnel?

Ty Heath: Out-market buyers move in-market when they enter a buying situation for your category. Customers are not in an ‘awareness’ or ‘consideration’ stage. They are either in-market, meaning they have been triggered to say, ‘I need a solution now!’ or they are not thinking about your category at all.

People move themselves in-market when they experience a pain point or need for a new solution. To achieve long-term growth, you must reach the 95% of buyers who are out-market today, so that when they enter the market in the future, your brand is the one they think of.

How do you do that? Brand building. And that is a matter of memory generation rather than lead generation.

Q7: What are category entry points (CEPs) and how should marketers use them?

Ty Heath: Every buyer is different, but there are common and recurring needs, pain points, and motivations that buyers in your category experience when they enter the market. We call these category entry points. For example, needs for scalability, reliability, or savings could be the three primary CEPs in your category.

But like with anything else in business, you cannot boil the ocean. To build mental availability and move the needle, marketers need to identify and prioritize five to eight CEPs. This is where the three C’s come in: credibility, competitiveness, and commonness. We can apply these lenses to all the category entry points in our category to identify the ones that make the most sense for us to invest in.

First, you must elicit all category entry points, and then you can start eliminating the ones that do not matter by asking how common and competitive they are, as well as how credible your brand is. If you are a small business and you cannot conduct a full survey of your category to answer these questions, you can start by interviewing your sales team or your salesperson or doing a little focus group with customers.

Regardless, use the criteria of credibility, competitiveness, and commonness, and decide on five to eight different situations where you can build a memory structure connected to your brand. And then make these buying situations the center of your messaging strategy. Stick to one situation per creative to keep it simple and memorable. And remember to make sure that all your messages and marketing activities are in service of your CEPs – anything outside this scope dilutes your focus and impact.

This is the idea of capital allocation, which is a prevailing mentality across business executives and boardrooms. Capital allocation is all about making trade-offs to maximize your impact, which is why we say that category entry points are capital allocation for marketers.

Q8: Can you give us an example of some real-life CEPs?

Ty Heath: Say you sell cloud software. Of course, buyers want this solution because they want to be able to store and share files in the cloud. But go one level deeper. Ask why they want these capabilities. It could be that they have faced cybersecurity risks, which make secure file sharing more important, or they need a cloud solution that easily integrates with Microsoft Office to avoid adoption challenges.

Once you have reached these underlying reasons, you understand why these people may enter a given buying situation. You can then start to message around these needs, pain points, and motivations.

Q9: If you had to articulate the new marketing funnel based on CEPs in just 2 or 3 sentences that a business could easily understand, what would you say?

Ty Heath: We use the acronym RMB to help brands stay remembered. The brand that is remembered is the brand that is bought.

Reach: Reach the entire category.

Message: Message around your key category entry points

Brand: Brand everything. Invest in distinctive brand assets to make sure you are generating situational memories that buyers link to your brand.