Marketing to the CFO

1. Why should CMOs market to the CFO? Why should the CFO be a more important internal stakeholder?

Ty Heath: It has always been vital for marketers to engage with the CFO for commercial reasons. The CFO role has evolved in recent years, presenting new opportunities for collaboration.

Strengthening the bond between marketing and finance is essential for a few reasons. First, the CFO has the final say on budgets, KPIs, and overall success. Collaboration between marketing and finance also helps ensure that our strategies align with the company’s overall vision and goals. Improving the relationship helps us protect budget and earn approvals because we have aligned our efforts with those financial goals.

Second, the influence of finance departments in businesses is expanding during economic downturns, and marketers must learn to align better with them to create value and shore up the business. Marketing has a direct effect on growth and margin, but critically, also protects cash flow and share in challenging times.

Finally, both marketing and finance are pivotal relationships that hold the keys to the business, finance with the power to invest, spend or save, and the vision for the future. Marketing serves as the voice of the customer and the driving force behind expanding and growing businesses, as well as the window to the category.

When we collaborate, we achieve better results, weather economic downturns and ultimately drive success for the business.

2. How have the roles of the CMO and CFO evolved?

Ty Heath: Over the past five years, the role of the CFO has undergone significant changes. Many CFOs have control over key areas that matter to the CMO, including strategy, data, digital, and pricing. This shift means that it’s now more critical than ever for us to establish a strong bond with our finance colleagues.

We also need to reinforce the understanding with CFOs that brand building contributes to revenue. Marketers have seen a loss of control over the 4-Ps: product, pricing, placement, promotion. Especially in B2B, marketers’ scope has been reduced to just promotion. But given our broader view of the external market and the customer, we are critical stakeholders across each of the 4-P’s – especially the ones we don’t currently control. Bridging the gap between marketing and finance will promote a more customer-centric strategy, creating enhanced value for both the customer and the company.

3. How should marketers invest in strengthening and amplifying ‘value for customers’ as an asset with stakeholders?

Ty Heath: A distinctive asset for a B2B marketer lies in understanding how your customers perceive and receive value. But unfortunately, there’s often a disconnect when it comes to understanding the value that marketing contributes. According to a Journal of Marketing article, only 2.6% of boards have a marketing experienced board member, and only 4% of board members think marketing experience is important, while 47% believe financial experience is important.

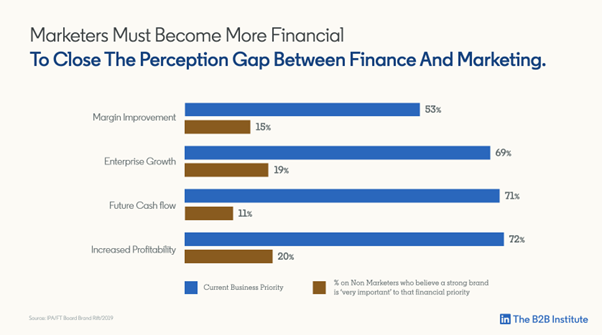

This is concerning, especially since brand marketing has the power to move metrics and can be the tool businesses need to drive growth. However, many companies fail to make the connection between investing in brand and their current priorities. For instance, 71% of companies state that cash flow is a current priority, but only 11% feel that ‘brand’ contribute towards it. Similarly, only 20% feel that brands contribute to increased profitability yet 72% declare it a major objective.

Our ultimate goals are the same: to create sustainable value for the organization. To address the disconnect, we need to focus on education, communication, and a mindset shift.

By working together on projects such as brand extension or creating a new brand for a new target segment, we can assess the risk, pricing structures, revenue, and profitability. We can also analyze the customer journey to improve margins without sacrificing customer satisfaction. We must promote ourselves as value creators and showcase how strategic and creative marketing can create clear financial value, driving growth and margin while protecting cash flow and market share in economic downturns.

So, the marketing-finance relationship needs to be reconstructed in many B2B organizations, and marketers need to promote the fact that their efforts create clear financial value.

4. What do marketing leaders need to understand about the language they use when connecting with the CFO and other finance peers?

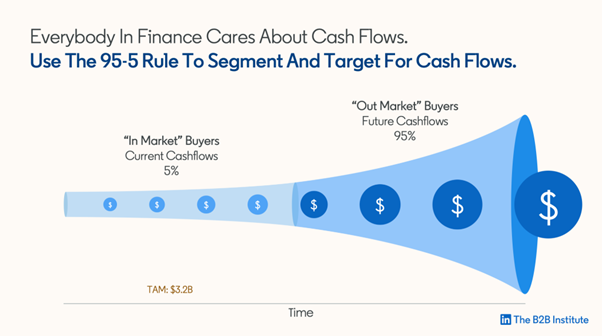

Ty Heath: If we want to be taken more seriously as marketers, we need to think, measure, and report in a way that is more familiar to finance. For instance, the most popular mental model in marketing is the marketing funnel. But we believe it’s more helpful to flip that funnel on its side and think about growth over time. Instead of distinguishing between “top funnel” and “bottom-funnel,” we should distinguish between in-market customers and out-market customers. This is a more customer-centric take on the funnel, and it has another major advantage: this funnel maps much more closely to finance and how CFOs think. CFOs think in terms of future and current cash flows. That’s what these two audiences deliver.

Using jargon outside of the marketing department can make you sound irrelevant instead of intelligent. Your colleagues may not understand how your contribution affects what matters. For example, even the term “investment” has a different meaning to financial colleagues, as it refers to a figure on a balance sheet. To avoid confusion and miscommunication, we recommend adopting the language of finance both inside and outside of marketing. This could mean using terms such as “future cash flow” instead of “long-term focus,” “sales pipeline” instead of “MQL,” “margin protection” instead of “brand halo effect,” and “stable market share” instead of “salience.”

This language shift doesn’t only apply to our KPIs – we also need to reframe our priorities to inform finance teams why these are priorities they should care about, too.

There is an opportunity for marketers to better absorb and communicate financial data, and connect marketing initiatives to business outcomes, as investment decisions will be compared to competing investment opportunities at the firm. That said, this is not a one-way street. Finance also has an opportunity to step into the world of marketing more deeply.

5. What role does culture play? What barriers hamper the alignment and communication for the marketing and finance relationship?

Ty Heath: Culture is key because relationships matter. Business happens more productively when there is better collaboration between people and teams. Work gets done more efficiently where there is trust and a track record of solving problems and delivering impactful results together. The opportunity here is to forge the necessary relationships between finance and marketing to make this happen. Whether it is having more regular standing meetings, planning sessions, or social occasions, the goal is to build bridges between marketing and finance.

As part of understanding your relationship with your finance leaders, it could be useful to start thinking of them as your customers. How would you assess the relationship? Strong? Tense? Difficult? Healthy? Distant? While healthy tensions may exist, a mature relationship should have certain qualities.

6. How do you cultivate an evidence-based mindset?

Ty Heath: Measuring the value of marketing efforts is crucial for business growth and clarity on marketing’s contribution to the bottom line. Before you start thinking about which metrics to use, have a clear understanding of how value is created within your organization. This will help you choose the most relevant metrics that accurately reflect the impact of marketing on the business.

Ask yourself, “which indicators are the most important drivers of business health and potential growth?” These metrics should be incorporated into all planning and briefing processes to ensure that marketing efforts are consistently evaluated against key benchmarks. No single metric can fully capture the value of marketing efforts, so develop an ecosystem of metrics that together provide a comprehensive view of marketing’s contribution to the bottom line. To make sure that these metrics are taken seriously and acted upon, the responsibility for their creation should be shared across marketing and finance teams. When you work together to develop and own these metrics, you are more likely to drive alignment and collaboration between departments.

7. Any concluding thoughts and advice for marketing leaders?

Ty Heath: It takes time and effort to shift the culture to create a more collaborative environment between marketing and finance. However, the benefits of making the effort are significant, not only for the organization but for individual careers as well.

With stronger relationships with finance, marketers gain a better understanding of the financial impact of their efforts and be better positioned to demonstrate the value they bring to the organization. This leads to greater recognition, career growth, and opportunities for advancement.

But let’s be real – this is not something that can happen overnight. This is change management and it needs to be done in a deliberate and thoughtful way. Simply implementing new processes won’t change attitudes, and it will take time to build trust and collaboration between the two departments.

Start with small steps and build on successes over time. It may take some time to fully realize the transformation, but the payoff will be worth it in the end!